How to keep track of your blogging income and expenses (plus free Blogging Accounts Spreadsheet)

I may get paid commission for purchases made after clicking a link in this post.

If you earn any income from your blog, you need to keep track of your blogging finances – both for your own benefit and for tax purposes. Discover how to keep track of your blogging income and expenses, plus grab a copy of my free, easy to use BLOGGING ACCOUNTS SPREADSHEET!

Do you make money from your blog? Or do you hope to make money with your blog in the near future? Then you need to keep track of your income and expenses – both for your own benefit and for tax purposes.

One of the reasons I love blogging so much is it is a relatively low risk way to earn good money, working from home and being your own boss.

However, one of the downsides to this is that, whilst it’s great being your own boss, it also means you have to do EVERYTHING yourself – and that includes keeping track of your income and expenses. There’s no accounts department to sort it out – it’s all on you!

The good news is – it’s not a difficult job. You just need good systems! With a good system in place, you can keep on top of everything easily and it won’t be a big scary job at the end of the year.

All you need is one simple spreadsheet and about 30 minutes a month to keep on top of things.

In this article I am going to share with you all the simple tips and tricks that I use to keep on top of my blogging finances – plus you can grab my BLOGGING ACCOUNTS SPREADSHEET – based on the exact same one I use, for FREE!

Two Important Caveats

Before we dive in, I just want to make two important caveats…

First and foremost, I AM NOT A PROFESSIONAL in this area – I am not an accountant, tax adviser, financial adviser, CPA or anything like it. The suggestions in this blog post should NOT be taken as any kind of formal, official or professional advice – if in doubt, you should always consult a proper professional in this area.

Secondly, I’m British and that’s the legal/tax system I know best. In the UK it’s OK to do all of this yourself (assuming you are a sole trader and under a certain income threshold). That may not be the case in your country, so please check. The suggestions I am giving in this post, though, should be pretty universal – it doesn’t matter what country you live in, you still need to keep track of your income and expenses. But please do take a moment to read up on the rules for your own country, if you are at all unsure.

OK, now we all know where we stand, let’s dive in…

First up – why bother?

Why should you track your blogging income and expenses?

Because it’s a legal requirement!

If you earn money from your blog (or even get freebies), you need track and keep records of your blogging income and expenses because it is a legal requirement to do so. You will also need to register as self-employed and file a tax return every year. In that tax return you will be required to declare all your income from blogging and your blogging-related expenses. In the UK you will be required to pay tax on your blogging profits and national insurance. (In other countries you may be required to pay other taxes as well.)

It is worth noting that in some countries you may not need to register as self employed until your income hits a certain threshold. (For example, in the UK this is £1000). However, there may still be advantages to registering as self-employed before you reach this threshold, so it is worth checking the rules and finding out more, even if you are only earning a small amount from your blog right now.

READ MORE >>> How to register as self-employed in the UK

So you pay the right amount of tax

It is important that you declare ALL your income (including freebies) AND your expenses. If you fail to declare some (or all) of your income you are guilty of tax fraud. So, keeping fully on top of your blogging INCOME is vital so that you don’t accidentally commit a crime!

It’s also important that you keep accurate records of your EXPENSES. Given that you pay tax on your profits, it’s important to you that you also declare ALL your expenses, so that you don’t end up paying too much tax. But obviously it’s also important to make sure you don’t claim for expenses you didn’t actually incur as a result of blogging or, again, you would be guilty of committing FRAUD!

To make sure you do actually get paid

A third really good reason to make sure you keep on top of your blogging finances is to make sure you actually get paid for work you have completed… If you have lots of money coming in from various sources (sponsored posts, affiliate links, ads, products, services etc.), you need to keep track of it all so you remember to chase up money that hasn’t paid. This is especially important for sponsored posts, which are often paid for a month or two AFTER you have done all the work. I find I have to chase up about HALF of all the sponsored posts I do to remind them I still need paying – if I didn’t have a robust system for this, I would lose out on income I am owed!

Tools you need to keep track of your blogging finances

As I said at the outset, keeping track of your blogging income and expenses is not especially difficult so long as you have a robust system in place. You need just three simple FREE tools to keep track of your blogging income and expenses…

1. A spreadsheet

First you need a simple spreadsheet where you can keep track of your blogging income, outgoings and profit. The good news is I have already made one for you! My free BLOGGING ACCOUNTS SPREADSHEET is based on the exact spreadsheet I use to keep track of my blogging accounts.

2. A lever arch file

You need somewhere to store ‘proof’ of your blogging income and expenses. Personally, I use a simple lever arch file*. If ever I am asked for proof of my income and outgoings by the tax man, I have it all in one place. Each item is numbered, and that number is logged on my spreadsheet. I keep all this in date order and by tax year, so it is very quick and easy to lay my hands on the exact document I need.

3. A folder in your inbox

The final piece of the jigsaw is a folder in your inbox labelled ‘Accounts’. This folder should be subdivided by year and by month. In this folder, I keep electronic versions of the ‘proof’ of my blogging income and outgoings. Whenever I get an email into my inbox which relates either to my blogging income (notification that I’ve been paid by my ad company, contract for a sponsored post, notification of affiliate income etc.) or blogging expenses (receipts and invoices for things I’ve bought), I immediately drag it into the current month’s folder.

At the end of the month I go through this folder and print everything off, add each item to my spreadsheet, assign each item a number and then write those numbers on the documents. Finally, I file those documents in my lever arch file. All this takes about 30 minutes per month – that’s it. Come tax return time I have all the information to hand that I need, and if ever I am audited, I have all the proof I need that my income and expenses are what I say they are.

Do you need software to keep track of your blogging finances?

You may hear other bloggers talking about using special software to track their blogging income and expenses, for example QuickBooks or Xero. Do you need it? Well, it depends. The truth is, in some cases you might need to use accounting software and so you should check the rules about this in your country. (For example, you need to use accounting software in the UK if you are VAT registered.)

However, if the rules in your country do not specifically state that you need you need to use special software to keep track of your income and expenses, and if your accounts are quite simple, then there is no need to use special accounting software.

(It’s also worth noting that, if you chose to hire an accountant, they may require you to use accounting software – and usually your accountant will have a particular software that they want you to use.)

Personally, I did not use accounting software for my blogging business until I got an accountant. I now use Xero, but I still use a spreadsheet to keep track, as it gives me a much better picture of my business finances than accounting software, in my experience.

How to keep track of your blogging income

So, the first thing to keep track of is blogging income. This is the system I recommend…

Every time you are notified that you have been paid, you should file that email in the correct month’s folder in your inbox. Additionally, every time you agree to something (e.g. a sponsored post) which you will be paid for, you should make sure you get that agreement in writing and file that in the same place.

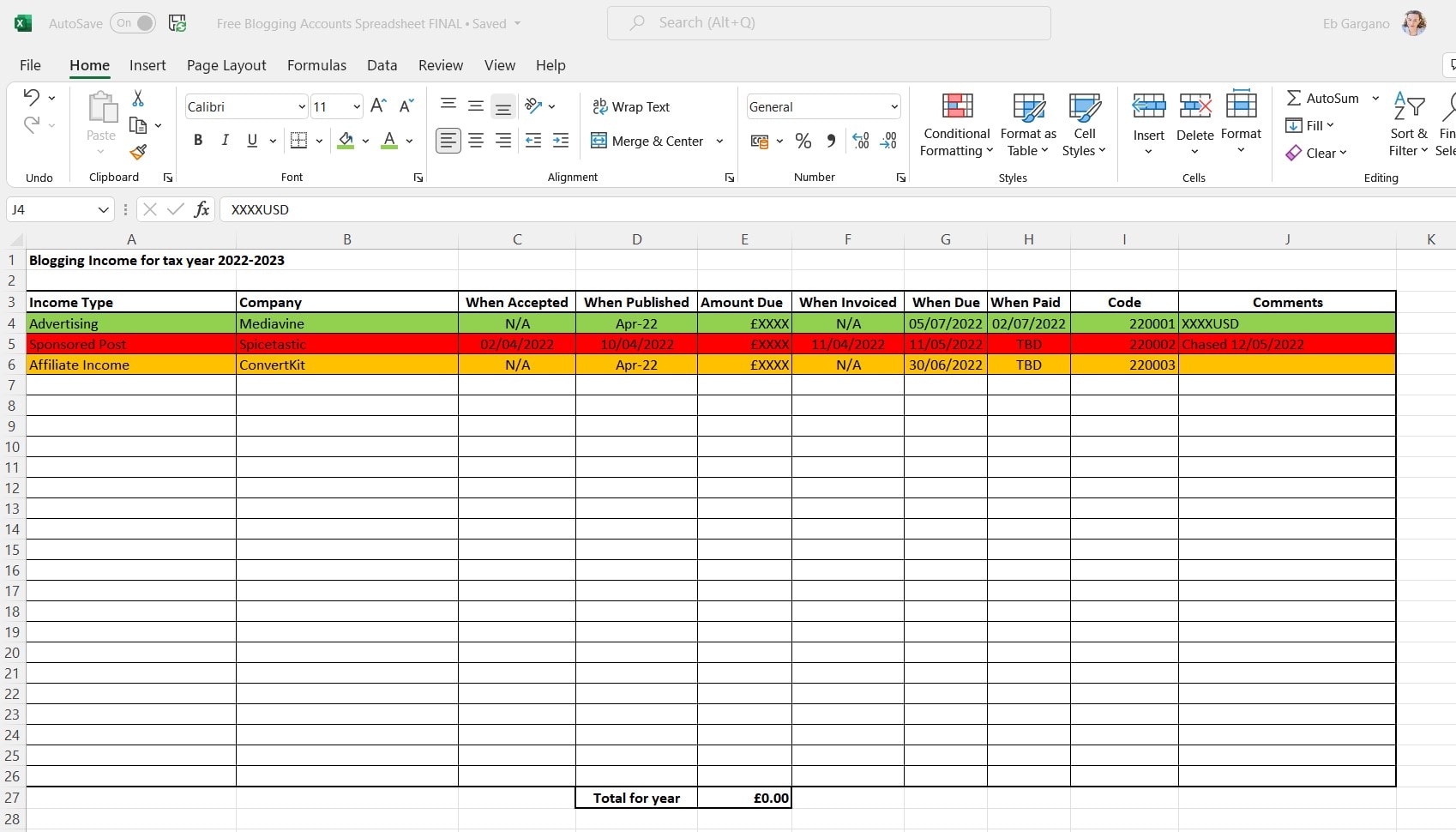

Once a month go through that folder, print out each document and make a note of all your income on the first tab of my spreadsheet.

For every piece of income, you should make a note of the following details:

- Income type (e.g. advertising, affiliate, sponsored post…)

- The company that’s paying you (e.g. Mediavine, Amazon…)

- When you accepted the job (if it’s a sponsored post)

- When you actually did the work to earn the money (e.g. published the sponsored post, or the month where you earned the advertising fee/affiliate income)

- The amount due

- When you invoiced (if it’s work that needs an invoice)

- When the money is due (it’s important to have this date so you know when you need to chase!)

- A unique code (see below)

- Comments – any notes, such as whether/when you’ve chased, amount paid in original currency (if it differs from your currency) and anything else you need to remember.

I recommend you keep every item of income in date order (by date accepted) and assign it a unique code. I use a very simple system for this. For example, for the tax year that runs 2022-2023, I assign the first two digits as 22 (because the tax year started in 2022) and then 0001.

So, for the first piece of income in April 2022, my code is 220001, the second one is 220002 and so on. When it’s the start of the tax year in April 2023, I’ll start again at 230001, 230002 and so on. (I’m banking on not getting more than 9999 different pieces of income each year!)

Once I have transferred all my income to the spreadsheet, arranged it in date order and assigned my codes, I then write the corresponding code on each document. I ensure these documents are in the correct order and then file them in my lever arch file.

If the income I am due requires an invoice, the unique code goes on the invoice and I print and file a copy of that invoice for my own records, as well as sending it to my client.

On the spreadsheet, I colour code income that I have RECEIVED in green, income that is DUE in orange and income that is OVERDUE in red – this helps me see at a glance if there is anything that needs to be chased! If there is income that is overdue, I chase it then and there, so I don’t forget and make a note that I have done so, and the date chased, in the comments section.

Then I move onto my expenses…

How to keep track of your blogging expenses

I recommend you deal with blogging expenses in a very similar way. Every time you pay for something related to blogging, you should file the receipt or invoice in the correct folder in your inbox.

If you don’t have an electronic copy of the receipt (for example, because you bought it in a shop), you should place the paper receipt in a safe place (my paper receipts have their very own in-tray). It’s also good practice to scan / photograph paper receipts so you have a digital record of them. You can then email them to yourself and file them in the correct folder in your inbox so everything is together.

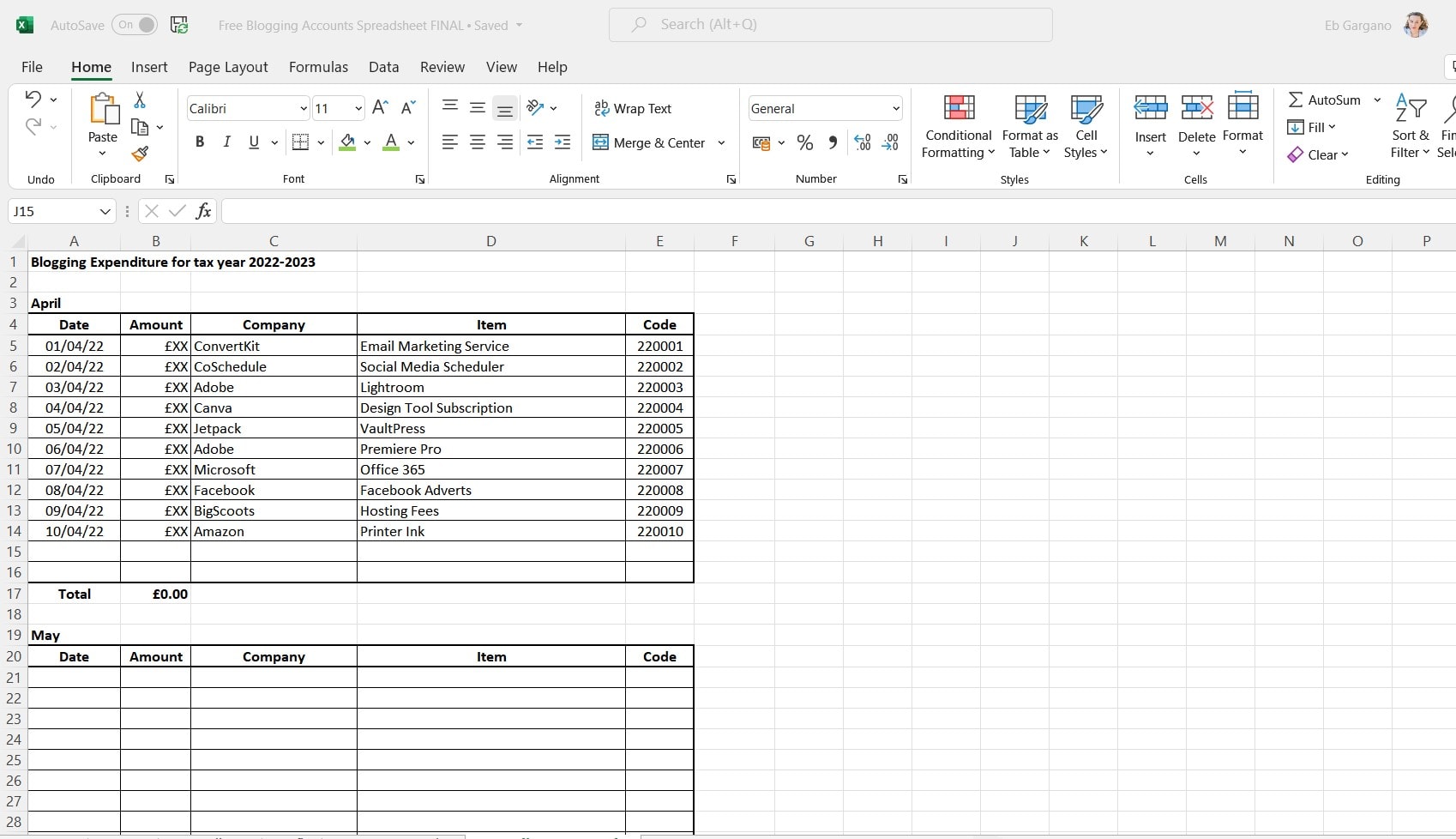

Once a month I recommend you go through the folder in your inbox and print out each document (and grab any paper receipts from your in-tray) and make a note of all your expenses on my spreadsheet.

For every expense, you should make a note of the following details:

- Date purchased

- Amount

- Company you bought it from (e.g. SiteGround, ConvertKit, Amazon)

- Item (or service) bought

- Code (I give every expense its own unique code too)

I keep every expense in date order (by date bought) and, just as with my income, I assign it a unique code. I assign codes for expenses in exactly the same way as I do with my income, so 220001 for the first expense of the tax year in April 2022 and so on. (Again, I’m assuming I won’t have more than 9999 expenses in each tax year – I really hope that never happens!)

Once I have transferred all my expenses to the spreadsheet, arranged them in date order and assigned my codes, I then write the correct code on each document. I ensure these documents are in the correct order and then file them in my lever arch file.

With this done, I can check how my profits are looking for the tax year in question…

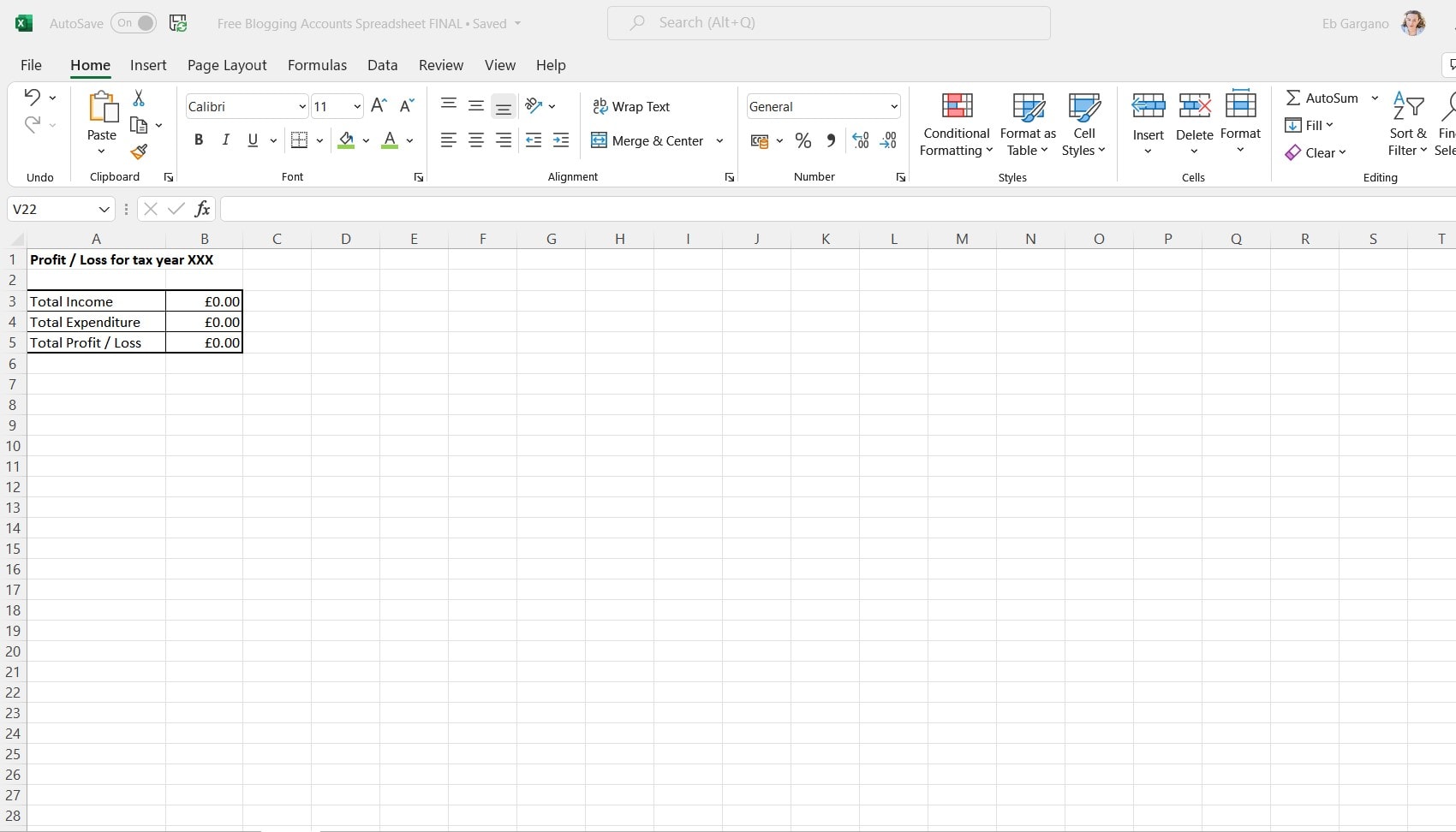

How to keep track of your blogging profit

The way I have my spreadsheet set up means that all the totals for blogging income and expenses are automatically calculated and that total automatically populates the third tab on my spreadsheet – the profit/loss tab.

This is just a simple calculation: income minus expenses. Hopefully the resulting figure is always positive – that means your blogging activities are generating a profit!

What should you keep track of?

As far as income goes, you should keep track of ALL of it. Anything that you earn from your blog and its related activities (for example if you offer services, do freelance writing etc.). Freebies also count as blogging income as well, and their value should also be logged on your blogging income tab too. (This is one of the many reasons why I do not recommend you work for product only!)

As regards expenses, you should obviously take note of what is allowed in your country, (e.g. HMRC guidelines if you are in the UK), but in general you can include any expense you occur as a direct result of your blogging activities. For example:

- Web hosting (e.g. SiteGround, BigScoots)

- Domain name registration fees

- Premium themes (e.g. Restored 316, Feast)

- Premium plugins (e.g. Social Warfare, WP Recipe Maker)

- Email marketing services (e.g. Mailchimp, ConvertKit)

- Design and editing tools (e.g. Lightroom, Premier Pro)

- Social Media Scheduling (e.g. CoSchedule, Buffer)

- Backup services (e.g. VaultPress, UpdraftPlus)

- Design/marketing materials (e.g. business cards, logo design)

- Computer equipment/printer

- Photography equipment

- Paid stock photos

- Stationery & office supplies (e.g. pens, paper, stamps, files, printer ink)

- PO box fees (e.g. for use on your email newsletter)

- Blogging courses and conferences

- Blogging related books and magazines

- Travel costs (e.g. to a client or blogging conference)

- Staff costs (e.g. if you employ a VA)

If you work from home, you may also be able to be able to claim for a proportion of your costs for things like heating, electricity, internet use and so on.

What to do about tax as a blogger?

As I mentioned above, as soon as you start earning from your blog, you should check if you need to register as self employed and start tracking your income and expenses. At the end of each financial year, you will need to complete a self-assessment tax return if you are registered as self employed.

In the UK the self-assessment tax return must be filed by the end of January the following year. So, for example, the self-assessment tax return for 2021/22 must be filed by 31st January 2023. To find more information about how to register as self-employed in the UK and get a self-assessment tax return visit the HMRC Website.

Filing a tax return is nowhere near as scary as it is made out to be. When I did it myself, it usually took me about an hour once a year and it’s really just answering a series of questions about your business (AKA your blog) and giving the figures for your income and expenses for the tax year in question. If you’ve done good job of keeping track of your blog’s finances all through the year, it’s really nothing to be daunted by.

I also recommend that you do not leave filing your tax return until the last minute. This is because a huge proportion of people leave filing their tax return to the very last minute and so the helplines get jammed – meaning you will find it difficult to get help and advice at the last minute… and you will have to spend far longer in queues waiting for help. Having done this one year, I can tell you, this is VERY stressful. So, do yourself a favour and file your tax return as soon as you can!

Don’t forget to save for tax!

At the beginning of each tax year, you should familiarise yourself with the tax rates and allowances for the year and estimate how much tax you think you will have to pay, based on how much you are currently earning and how much you think you will earn in the next tax year. You should make sure you set aside enough money each month to cover your tax. That way there will be no nasty surprises when you get your tax bill!

If you are in the UK you can check out the HMRC website for more information on how much tax you have to pay and when you will have to pay your tax bill. They also have a handy little calculator to help you work out how much tax you will have to pay, based on your monthly income.

Grab a free copy of my blogging accounts spreadsheet

Want to stay on top of your blogging finances? Grab yourself a free copy of my blogging accounts spreadsheet…

Want to read more about blogging basics?

If you’ve enjoyed this post you may like to read more about blogging basics. Here are some of my most popular posts on this topic…

- What is a blog and how does it work? Blogging explained!

- How long does it take to make money blogging?

- How much do bloggers REALLY earn? (Statistics from the Blogging Income Survey)

- How much does it REALLY cost to start a blog?

- How to treat your blog like a business (and start actually making money!)

Any questions?

I’d love to help if you have any questions about this topic. Feel free to ask in the comments below or over in my Productive Blogging Community.

Don’t miss a thing!

Follow me on Twitter, Facebook and Instagram. Or why not subscribe to Productive Blogging and get blogging and productivity tips straight to your inbox every week?

Pin this post to read later

*This blog post contains affiliate links, this means if you click on a link and go on to buy the product I recommend, I will get a small commission, but you will not be charged a penny more – thanks in advance!

This is great info, thank you. I am not at the point where I am earning anything yet with my blog, but when the time comes I shall revert back to this. Thanks.

Thanks Emma – so pleased you found this helpful! Eb 🙂

Great info! Newbie here and this helps! May I know for blogging incomes and expenses, does all info (eg. email add and name) have to match exactly what you registered yourself?

Also, does one have to keep a hard copy of the records and for how many years? Thanks in advance.

Thanks Desiree! Re: your first question – what do you mean by ‘all info’? Do you mean does the info on invoices/receipts have to match the info given to HMRC? (or your country’s tax authority, if you are not in the UK) If that’s what you mean, then my understanding is, no – it does not have to match. But I would double check with the relevant tax authority to make sure. Yes, you should always keep both hard and electronic records. HMRC’s website says you should keep your records for 5 years >>> https://www.gov.uk/self-employed-records/how-long-to-keep-your-records (if you are not in the UK I suggest you google the name of your country’s tax authority and ‘how long do I need to keep records?’ – the answer is likely to come up as the first hit!) Eb 🙂

Hi,

Really thankful for your helpful info! I’m just confused and wondering whether if the expenses and income received need to match your personal/company info registered (as there isnt much info out there on taxes and filing taxes for bloggers etc).

Just a quick question, do you think there’s still a need to invest in a .com blog for bloggers? I think it’s okay for evergreen content bloggers, but I think people dont read blogs nowadays. Some bloggers websites have not been updated since 2017?

What do you think?

Thanks again for your help above 🙂

I would definitely always advise getting a .com ending for your blog if at all possible. I also advise that the majority of your posts should be evergreen as this will give you more pageviews in the long-run. Most bloggers find that search engines bring them the most traffic in the long term and search engines will drive traffic to all relevant blog posts, so by having lots of evergreen content, you will continue to get traffic to your older posts. People don’t necessarily read blogs in quite the same way as they used to… but search engines are driving more and more traffic to blogs. The most successful blogs are therefore those that focus on search engine optimisation (SEO). Yes, you are right that some bloggers have stopped blogging, but many more people are taking up blogging every day. Blogging is growing all the time as more and more people are wising up to the fact that you can make serious money from blogging! Hope that helps 😀 Eb x

Holy guacamole! This is GREAT information – thank you so much for sharing. I have been quite daunted by the idea of doing my own taxes and recording my own income and expenses as a new blogger. This is some of the most helpful information I have found so far. Thank you especially for the free spreadsheet. This saves me so much time and is already organized and set up for my own use which I appreciate so much!

Thanks Danielle – I’m so pleased you found this useful! Eb 🙂

This is the post I’ve been waiting for! Working my way through this starting tonight!

Yay! Hope you find it helpful 😀 Eb x

I just downloaded the Excel spreadsheet! It’s exactly what I’ve been looking for! Thanks for sharing.

A pleasure! So pleased you found it helpful 😀

Really informative post. And helpful.

I have my own spreadsheet, and am new to blogging (not new to business though). To get an on-site into how a blogger manages their finances is really helpful.

Thank you.

Thanks for this lovely comment, Damion. I am so happy you found my post helpful! Eb 🙂

These spreadsheets are great, but much better would be a Google sheets version.

Thank you for your feedback. I make my spreadsheets in Excel as I personally much prefer Excel. But they can be easily turned into a Google Sheet, if that’s what you prefer. Simply drag the Excel spreadsheet into Google Drive and then right click on the spreadsheet and select ‘open with Google Sheets’. Finally, save as a Google Sheet.

Thanks for uploading this article! Was a helpful one in understanding to keep a track of my expenses.

Great to hear!

Thanks for the article! Will help a lot in keeping track of my blogging expenses.

You are welcome! That’s great to hear 😀